[ad_1]

The story so far: In a bid to deepen ties in Asia and Africa, the heads of the BRICS nations (Brazil, Russia, India, China, and South Africa) are scheduled to meet in Cape Town, South Africa on August 22-24 this year. The bloc, which is seen as a counter to the G7, is also mulling expansion.

The BRICS nations’ foreign ministers met in Cape Town on June 2, 2023, to strengthen the bloc’s influence globally. Expansion was on agenda as ministers from Algeria, Argentina, Iran, Saudi Arabia, the United Arab Emirates, Egypt, and Kazakhstan were also present.

In a post-meeting statement, South Africa’s foreign minister Naledi Pandor said that Shanghai-based New Development Bank (NDB) had briefed the BRICS minsters about potentially using alternative currencies to ensure the bloc does not become victim to sanctions which affect countries not involved in the original issue.

External Affairs Minister S. Jaishankar with his counterparts from Brazil, Russia, China and South Africa after a meeting of BRICS Foreign Ministers, in Cape Town, South Africa, Thursday, June 1, 2023.

| Photo Credit:

PTI

The bloc also issued a joint statement titled ‘The Cape of Good Hope’, underscoring the use of local currencies in international trade and financial transactions between BRICS and its trade partners. The BRICS represent 41% of the global population, 24% of the world’s GDP, and conducts 16% of the world’s trade.

Origins of BRICS common currency

Last year, soon after invading Ukraine, Russian President Vladimir Putin, proposed the idea of ‘alternative transfer mechanisms’ with BRICS partners and an ‘international reserve currency.’ Addressing the BRICS business forum via video link, on June 22, 2022, Mr. Putin said that Russia was actively redirecting its trade flows and economic contracts to ‘reliable partners’ such as India, China and other BRICS nations to counter crippling sanctions levied by the European Union, the US, UK and other Western powers.

Pushing for independence from the US dollar and Euro, Mr. Putin said that Western sanctions were neglecting basic principles of market economy, free trade and the inviolability of private property as Russia was forced to seek new markets and strengthen ties with nations in Asia and Africa.

Russian President Vladimir Putin attends a BRICS+ meeting during the BRICS summit via a video link in the Moscow region, Russia June 24, 2022

| Photo Credit:

SPUTNIK

The idea for a common BRICS currency is based on the bloc’s aim to globally realign the geopolitical situation to suit its member nations’ economic, geographic and demographic advantages. The bloc, which was created in 2009, established the multilateral New Development Bank (NDB) in 2015 for mobilising resources for infrastructure and projects in emerging markets and developing countries. Via NDB (previously known as the BRICS Development Bank), BRICS aims to counter the West’s dominance in global financial institutions like the World Bank or the International Monetary Fund.

BRICS expansion & economic influence

Through the years, several nations have expressed interest in joining BRICS to counter Western alliances like G20, NATO, and the European Union. In the recently concluded BRICS Foreign ministers’ meet, over 40 countries expressed interest in joining the bloc. Among those interested are Iran, Saudi Arabia, the United Arab Emirates, Argentina, Cuba, Democratic Republic of Congo, Gabon, Kazakhstan and Algeria.

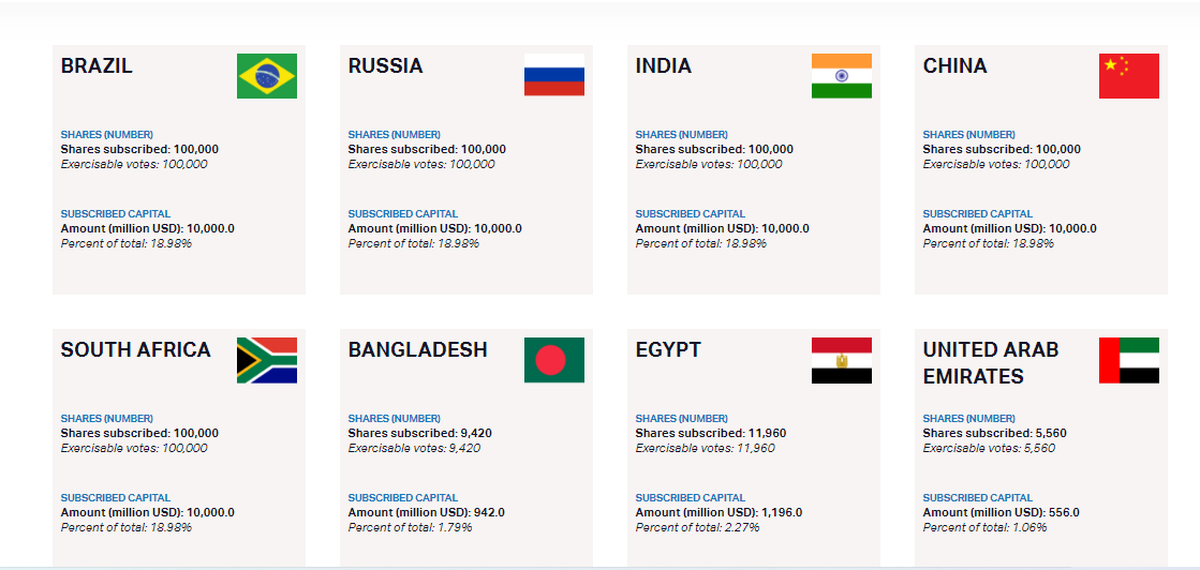

Prior to joining the bloc, many prospective nations have invested in NDB, the latest being Algeria. Its president Mr. Abdelmadjid Tebboune said his country formally applied to join the NDB with a $1.5 billion contribution. Bangladesh and United Arab Emirates joined the NDB in 2021, while Uruguay’s request was also accepted. In March this year, Egypt became an investor in NDB.

Currently, Argentina, Saudi Arabia, and Zimbabwe are mulling investments in NDB and also seek membership in the bloc. In May, Saudi Arabia expressed interest in investing in the bank as it seeks to diversify its investments in Asia. Aiming to build closer ties with India and China, Saudi Arabia — the world’s largest oil exporter — sees this as an opportunity to expand its market.

BRICS’ expansion has been hit by the sanctions on founding member Russia, which has a 18.98% stake in NDB, due to its invasion of Ukraine. In March 2022, NDB was forced to halt all new transactions in Russia citing “unfolding uncertainties and restrictions.” Several global banks and nations halted Russia’s SWIFT transactions, froze the Russian central bank’s assets and assets of certain Russian individuals.

Shareholders of the New Development Bank

BRICS’ expansion is also being stalled by India and Brazil opposing China’s approach towards increasing the bloc’s influence. Brazil fears that the bloc’s expansion will attract countries which view BRICS as an opposing force to the European Union and the United States, while India wants rules to be framed about how nations will be considered for membership over time.

In the recent Cape Town meeting, Indian External Affairs Minister S Jaishankar called the expansion a “work in progress.” He said that it was necessary to view how BRICS engages non-BRICS countries and what would be an appropriate format for the bloc’s possible expansion. Concurring with India, Brazil’s Foreign Minister Mauro Vieira said that BRICS is a brand which has to be taken care of as it represents a lot. In contrast, Chinese Vice Minister Ma Zhaoxu said that its proposed BRICS+ was developing ‘very fast’.

Push for local currency usage

To attract more countries to the bloc, BRICS has pushed for the usage of the member nations’ local currencies for bilateral trade, also reiterating this in the joint statement from the Cape Town meet.

While the statement made no direct reference to the sanctions on Russia, the bloc noted the complications created on the world economy by “unilateral economic coercive measures such as sanctions, boycotts, embargoes and blockades,” calling for a peaceful resolution of the situation in Ukraine via dialogue and diplomacy.

Initially, when Russia was hit with sanctions, India mulled reviving its Rupee-Rouble trade agreement – an alternative payment mechanism to settle dues in rupees instead of dollars or Euros. However, talks were dropped later as traders found the currency conversion expensive and Moscow refused to keep a rupee surplus amounting to $40 billion in its reserves. It used the Chinese Yuan to pay for part of its oil imports from Russia, skirting Western sanctions.

This handout image provided by the UAE Ministry Of Presidential Affairs shows UAE President Sheikh Mohamed bin Zayed al-Nahyan (R) welcoming Prime Minister of India Narendra Modi during an official reception in Abu Dhabi, on July 15, 2023.

| Photo Credit:

AFP

Recently, India signed the Rupee-Dirham deal during Prime Minister Narendra Modi’s visit to Abu Dhabi. While UAE Ambassador to India Abdulnasser Alshaali said that the deal was not a move to de-dollarise the global economy, the agreement aims to interlink the two nations’ payment and messaging systems as well as increase the circulation of the rupee in the Gulf region. As of date, the Reserve Bank of India has allowed banks from 18 countries to trade in rupees— Botswana, Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Russia, Seychelles, Singapore, Sri Lanka, Tanzania, Uganda and the United Kingdom.

India’s BRICS partner China already trades with over 120 countries using the yuan. The push for local currency deals among the bloc and globally is seen as the bloc’s move to assert its economic potential and get closer to a EU-like common currency.

BRICS Pay and common currency

Facilitating easier transactions between BRICS nations, the bloc launched the BRICS Pay project in 2018 under the BRICS Business Council, enabling digital payments between members without converting to their respective local currencies. The payments mechanism will combine central bank digital currencies (CBDC) and decentralised currencies (i.e. cryptocurrencies). It is still in the discussion stages.

The push for a common EU-like currency has found support from two member nations — Russia and Brazil. While Mr. Putin was the first to propose it, Brazil’s new President Luiz Inacio Lula da Silva has been a vocal supporter for a common currency as well. He claimed that such a move would help developing countries reduce their dependency on the U.S. dollar.

Logo of proposed BRICS Pay system

However, NDB’s Chief Financial Officer (CFO) Leslie Maasdorp ruled out any immediate plans to introduce a BRICS common currency. Despite the bloc’s growing economic clout, Mr. Maasdorp opined that even the Chinese Renminbi was far from achieving the status of a reserve currency. Similarly, South Africa and India have both denied any talks of a BRICS currency. India has asserted that its focus is on strengthening its national currency and promoting its trade with all global powers.

In the upcoming BRICS summit scheduled for August 22-24 this year at the Sandton Convention Centre in Johannesburg, South Africa, the BRICS common currency’s biggest advocate — Mr. Putin — will not be in attendance as he faces an arrest warrant issued by the International Criminal Court (ICC) for alleged war crimes in Ukraine. The summit will see both Russia and China push for expansion as India and South Africa remain wary.

- The BRICS nations’ foreign ministers met in Cape Town on June 2, 2023, to strengthen the bloc’s influence globally.

- The bloc also issued a joint statement titled ‘The Cape of Good Hope’, underscoring the use of local currencies in international trade and financial transactions between BRICS and its trade partners.

- Through the years, several nations have expressed interest in joining BRICS to counter Western alliances like G20, NATO, European Union.

[ad_2]

Source link